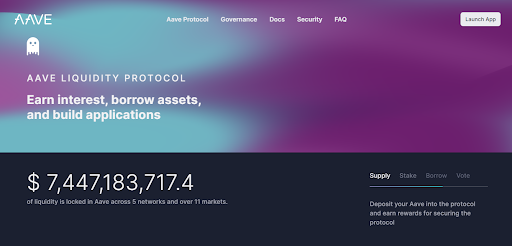

Aave is a decentralized finance (DeFi) platform allowing users to borrow various cryptocurrencies without intermediaries. Aave is one of the most popular and innovative DeFi platforms in the market, with over $17 billion in total value locked (TVL) as of August 2023.

Aave offers a range of features and benefits for both lenders and borrowers, such as high-interest rates, flash loans, collateral swapping, governance tokens, and more. This article will Aave review and its main features, pros, cons, and risks. We will also show you how to use Aave and provide some tips and best practices for using this DeFi platform.

Quick Overview of Aave

- Aave is a well-known liquidity protocol with substantially bigger liquidity pools than its competitors.

- The Defi lending protocol is open source, allowing adaptations for developers.

- The crypto-based protocol enables users to earn interest on deposits and borrow assets.

- The lending platform offers collateral swaps (uncommon on decentralized platforms), yet changing interest rates are seen for particular assets.

- It offers steady rates for borrowing certain assets.

- Another option is to get uncollateralized flash loans (of a modest amount).

How Did Aave Start?

Aave CEO Stani Kulechov invented the Aave protocol in 2017. At first, Aave utilized LEND as the token and took inspiration from the Ethereum network. It successfully raised more than $16.2 Million after its maiden sale.

Aave has gone a long way since its founding and is now one of the top platforms in the rapidly expanding Decentralized Finance (DeFi) industry.

The idea of transparency and an utterly open infrastructure for a digital financial system (based on blockchain) drove its creation and success. Aave soon grew to dominate the industry by introducing unmatched features and functions. Aave protocol launched some new decentralized financial companies along the way.

Aave Review – Interface for Platforms

What is Aave?

Aave is a DeFi protocol that runs on the Ethereum blockchain. Aave allows users to deposit and withdraw various cryptocurrencies, such as ETH, DAI, USDC, WBTC, etc., into liquidity pools.

These pools are then used to facilitate lending and borrowing activities on the platform. Users who deposit funds into the collections are called lenders or depositors, and they earn passive income from the interest paid by the borrowers.

Users who borrow funds from the pools are called borrowers or debtors, and they pay interest to the lenders. Borrowers can also use their deposited funds as collateral to borrow other assets from the platform.

Aave was launched in 2017 as ETHLend, a peer-to-peer lending platform allowing users to create loan contracts. In 2020, ETHLend rebranded to Aave and introduced a new protocol that enabled users to access liquidity pools instead of individual lenders.

Aave also introduced new features, such as flash loans, rate switching, collateral swapping, etc. That made it more attractive and competitive in the DeFi space.

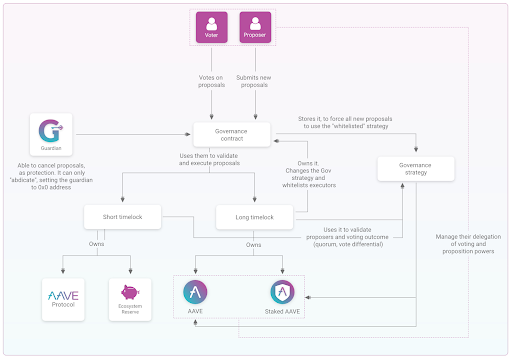

Aave is governed by its native token, AAVE, launched in October 2020. AAVE holders can stake their tokens to secure the protocol and earn rewards. They can also participate in the protocol’s governance by voting on proposals and changes.

AAVE holders can also benefit from the protocol’s fee distribution mechanism, which allocates a portion of the fees collected from borrowers to the stakers.

Aave is a DeFi protocol that runs on the Ethereum blockchain

How Does Aave Work?

The basis for lending and borrowing digital assets and cryptocurrencies is Aave. The protocol may lend or borrow cryptocurrency, which can pay interest. While the protocol charges for flash loans, the transactional price is free for specific tokens.

One benefit of such a vast operation and utilization scale is that certain assets’ interest rates remain steady. Aave supports around 15 cryptocurrencies, albeit not all may be utilized as collateral when requesting a crypto loan. These resources include ETH, ETHlend, etc., but are not restricted to these.

Aave supports around 15 cryptocurrencies

What are the main features of Aave?

Aave offers a number of features that make it stand out from other DeFi platforms. Some of these features are:

High-interest rates

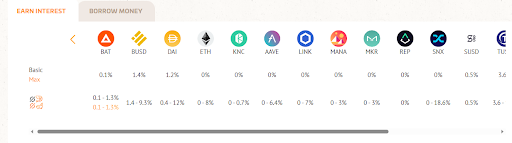

Aave offers both lenders and borrowers variable and stable interest rates. The variable rates are determined by supply and demand in each pool, while the regular rates are fixed at a certain level based on market conditions.

Users can switch between variable and stable rates at any time. Aave’s interest rates are generally higher than traditional lending platforms, making it more profitable for lenders and borrowers.

Aave offers both lenders and borrowers variable and stable interest rates

Flash loans

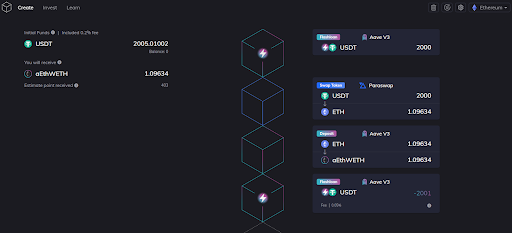

Flash loans are a unique feature of Aave that allows users to borrow any amount of funds from the platform without any collateral or credit check as long as they repay it within one transaction block (usually less than 15 seconds).

Flash loans can be used for various purposes, such as arbitrage, liquidations, refinancing, etc., but requires advanced technical skills and knowledge.

Flash loans are a unique feature of Aave

Collateral swapping

Collateral swapping is another feature of Aave that allows users to swap their collateral assets without closing their loan positions. This can help users avoid liquidation risks or take advantage of market opportunities.

For example, if a user has borrowed DAI using ETH as collateral and expects ETH to rise in price, they can swap their ETH collateral for another asset (such as WBTC) without repaying their DAI loan. This way, they can keep their exposure to ETH and benefit from its price appreciation.

Collateral swapping is another feature of Aave

Governance tokens

Governance tokens represent the ownership and voting rights of a DeFi protocol. Aave’s governance token is AAVE, launched in October 2020 to replace its previous token, LEND.

AAVE holders can stake their tokens to secure the protocol and earn rewards. They can also participate in the protocol’s governance by voting on proposals and changes. AAVE holders can also benefit from the protocol’s fee distribution mechanism, which allocates a portion of the fees collected from borrowers to the stakers.

Governance tokens represent the ownership and voting rights of a DeFi protocol

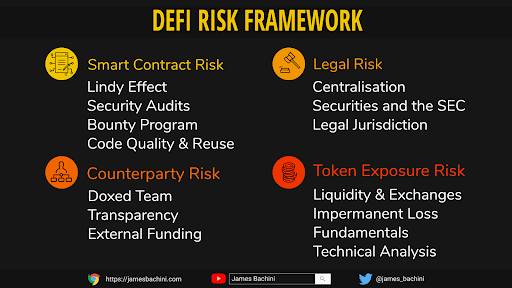

Risk management

A vital element is risk management of any DeFi platform, as it ensures the protocol and its users’ security and stability. Aave has several risk management features, such as:

- Liquidation: Liquidation is a process that occurs when a borrower’s collateral value falls below a certain threshold (called liquidation threshold), which puts their loan at risk of default. In this case, the protocol automatically sells their collateral at a discounted price (liquidation penalty) to repay their loan and protect the lenders. Aave’s liquidation thresholds and penalties vary depending on the asset and the market conditions. Still, they are generally lower than other DeFi platforms, which makes it less likely for borrowers to get liquidated.

- Reserve factor: The reserve factor is a percentage of the interest paid by the borrowers allocated to a reserve pool. The reserve pool acts as a buffer to cover potential losses or shortfalls in the protocol. Aave’s reserve factor varies depending on the asset and the market conditions, but it is generally higher than other DeFi platforms, which makes it more resilient and robust.

- Health factor: Health factor is a metric that measures the health and safety of a borrower’s position. It is calculated by dividing the collateral value by the borrowed value. The higher the health factor, the safer the place. Aave’s health factor ranges from 0 to infinity, but it is recommended to keep it above 1.5 to avoid liquidation risks.

A vital element is risk management of any DeFi platform

Pros and Cons – Aave Review

Aave has many advantages and disadvantages for both lenders and borrowers. Some of them are:

| Pros | Cons |

| A sizable lending pool is available for a variety of digital assets. | A few of the options are more user-friendly. |

| Provides extra tools for online borrowing and lending. | Just a few compatible e-wallets are listed. |

| Interest rates that are stable for certain crypto assets. | Users don’t have strong incentives to lend or borrow. |

How to use Aave?

To use Aave, you need an Ethereum wallet that supports Web3, such as MetaMask, Trust Wallet, Coinbase Wallet, etc. It would help if you also had some ETH or ERC-20 tokens you want to deposit or borrow on the platform. Here are the steps to use Aave:

- Visit Aave website and connect your wallet to the forum.

- Choose whether you want to deposit or borrow funds from the venue.

- Select the asset you wish to deposit or borrow from the list of available pools.

- Enter the amount you want to deposit or borrow and confirm the transaction.

- Review your position’s interest rates, fees, risks, and terms and approve it with your wallet.

- You can now see your position details on your dashboard and manage them accordingly.

The homepage – Aave Review

Tips and best practices for using Aave

Here are some tips and best practices for using Aave:

- Do your research before using Aave or any DeFi platform. Understand how they work, what are their features, pros, cons, risks, etc., and compare them with other alternatives.

- Use a secure and compatible wallet that supports Web3 and Ethereum transactions. Ensure you have enough ETH or ERC-20 tokens in your wallet to cover your deposits, borrowings, gas fees, etc.

- Monitor your positions regularly and keep track of your interest rates, fees, collateral value, borrowed value, health factor, etc. Adjust your posts accordingly to avoid losses or liquidations.

- Use stable interest rates if you want more predictability and certainty in your posts. Use variable interest rates if you want more flexibility and opportunity in your posts.

- Use flash loans only if you know what you are doing and have a clear strategy and purpose. Flash loans are risky and complex features that require technical skills and knowledge.

- Use collateral swapping only if you have a good reason and understanding of its implications. Collateral swapping can help you avoid liquidation risks or take advantage of market opportunities but also expose you to new threats or costs.

- Stake your AAVE tokens if you want to support the protocol and earn rewards. Staking your AAVE tokens also gives you voting rights and fee distribution benefits. However, be aware that betting your AAVE tokens also exposes you to risks, such as slashing or losing funds.

- Be careful with the gas fees when using Aave or any DeFi platform. Gas fees are the fees you pay to the Ethereum network to process your transactions. Depending on network congestion and demand, gas prices might change. Gas fees can also affect your profitability and risk management. You can use tools like GasNow or Etherscan to check the current gas prices and optimize your transactions.

Keep up with the most recent events and news of Aave and the DeFi space. Aave is a dynamic and evolving platform that constantly introduces new features, updates, and changes. You can follow Aave’s official Twitter, Medium, Discord, etc., to get the latest information and announcements. You can also join the DeFi community on platforms like Reddit, Telegram, YouTube, etc., to learn from other users and experts.

AAVE V3 DeFi Integration Tips

Aave Supported Wallets

Since the protocol is built for Ethereum, only Ethereum Mainnet and Polygon Mainnet wallets are supported.

Migrate to one of the compatible wallets to preserve their assets and data. A variety of wallets that work with both the Polygon Mainnet and the Ethereum Mainnet are listed below:

- Portis

- Ledger

- MEW wallet

- Coinbase

- Authereum

- Wallet Connect

- Torus

- Fortmatic

- imToken

- Browser Wallet

Migrate to one of the compatible wallets to preserve their assets

Future of Aave Review

The history is self-evident, and the present is dazzling. With its ever-expanding monster of a liquidity pool, Aave is destined to become one of the Decentralized Finance (DeFi) leaders and enjoy exponential success. Its market share and user base may grow with more support in the form of interoperability with the tokens from other wallets.

Security of Aave

The protocol’s designers gave security a top priority. By doing regular protocol audits and vulnerability checks, it is kept secure.

The protocol is susceptible to underlying code control since it is open-source. The team wants to update people on their security via their blog. The admin keys further enhance the platform’s security and management. The Aave protocol has been used to encrypt live streaming for around 54 currencies.

A desirable incentive for reporting problems is the team’s offer of a reward of up to $250,000 if the disclosed flaws and vulnerabilities prove substantial.

The protocol’s designers gave security a top priority

Aave Customer Support

The organization is allegedly working on a governance structure planned to be as revolutionary as flash loans to assist. There are several options available for users to choose from when contacting the staff.

These options include email, Discord, Twitter, Instagram, and Telegram. Aave has a sizable user base but is renowned for its responsive customer service.

Aave Customer Support – Aave Review

Conclusion – Aave review

With features and advantages for both lenders and borrowers, including high-interest rates, flash loans, collateral swapping, governance tokens, and more, Aave is a top DeFi platform. Aave is a secure and stable platform with several risk management features, such as liquidation, reserve factor, and health factor.

However, Aave is a sophisticated and complicated platform, so using it efficiently calls for technical expertise. Users must also know the market volatility, regulatory uncertainty, and gas fees that affect their positions and profitability. Therefore, users should research before using Aave or any DeFi platform and follow some tips and best practices to optimize their experience and results.

FAQs about Aave Review

Here are some frequently asked questions about Aave:

What is the difference between AAVE and aToken?

AAVE is the governance and security token of the protocol, while aToken is the interest-bearing token representing the deposited asset. For example, when a user deposits DAI into Aave, they receive aDAI in return, which accrues interest over time.

How can I get AAVE tokens?

Users can get AAVE tokens by buying them from exchanges, earning them from liquidity mining, or stalking them on the platform.

How can I stake AAVE tokens?

Users can stake AAVE tokens by depositing them into the Aave Safety Module, a last-resort insurance fund for the protocol. Users who stake AAVE tokens earn rewards in AAVE and BAL tokens and get a discount on their borrowing fees. Users who stake AAVE tokens also take on the risk of slashing, which means they could lose some or all of their staked tokens if the protocol suffers a severe shortfall event.

How can I use flash loans?

Users can use flash loans by initiating a transaction that borrows any liquidity from Aave’s pools, performs one or more operations with it, and repays it within the same transaction.

Users need technical knowledge and skills to use flash loans, as they require writing custom smart contracts or using existing tools and interfaces.

How can I switch between stable and variable interest rates?

Users can switch between stable and variable interest rates by clicking the “Switch” button on their dashboard. Users can change between interest rates at any time, but they need to pay a 0.15% fee for each switch.

How can I participate in governance?

Users can participate in governance by holding or delegating their AAVE tokens. Users who hold or charge their AAVE tokens can vote on proposals to upgrade or change the protocol and create new proposals if they have enough tickets. Users can use various interfaces and tools to participate in governance, such as Snapshot, Aavescan, or Zapper.